- Get link

- Other Apps

- Get link

- Other Apps

The concept of money laundering is very important to be understood for those working in the financial sector. It is a process by which dirty cash is converted into clean money. The sources of the money in actual are prison and the money is invested in a approach that makes it appear like clear cash and conceal the id of the legal a part of the cash earned.

While executing the financial transactions and establishing relationship with the brand new prospects or sustaining present customers the duty of adopting ample measures lie on every one who is part of the organization. The identification of such component in the beginning is simple to cope with instead realizing and encountering such situations in a while in the transaction stage. The central financial institution in any nation offers full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide enough safety to the banks to discourage such conditions.

This process is whereby businesses blend illegal funds with legitimate takings. Placement is often the most challenging stage for a money launder.

Cryptocurrency Money Laundering Explained Bitquery

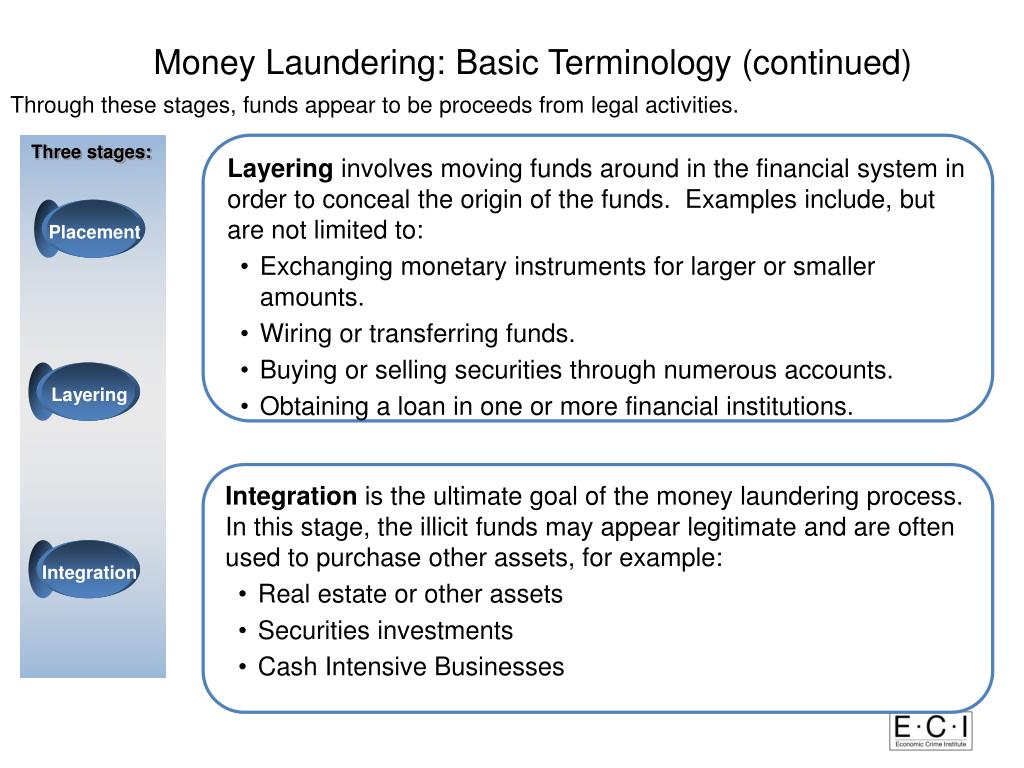

Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable.

Examples of money laundering placement. Sale or transfer of high-dollar items purchased with laundered funds Sale or transfer of real estate purchased with laundered funds Legitimate purchases of securities or other financial instruments in the launderers. Let me give you a real life example of stages of money laundering. Placement in which the money is.

Placement techniques often include structuring currency deposits into amounts to evade reporting requirements or commingling the deposits of both legal and illegal enterprises. And at the same time hiding its source. Placement Stage Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc.

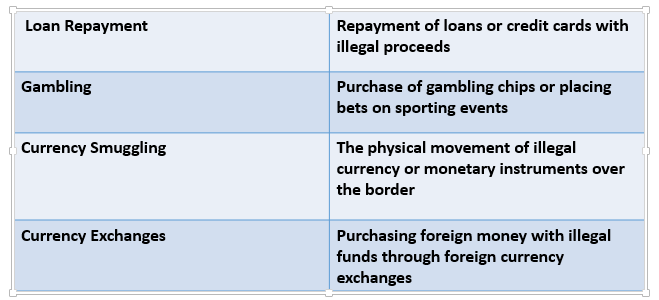

Examples of integration include. There can be several ways to do money laundering but the most popular is the establishment of the fake companies which is also known as the shell companies. Examples of Money Laundering.

Other examples of placement may include using the money to pay off debts converting the cash to chips in the casino or falsifying invoices in a legitimate business. For example the purchases of property artwork jewelry or high-end automobiles are common ways for the launderer to enjoy their illegal profits without necessarily drawing attention to themselves. Money laundering typically includes three stages.

Dividing large amounts of currency into less conspicuous smaller sums that. Each time exploiting loopholes or discrepancies in legislation and taking advantage of delays in judicial or police cooperation. In the first phase called placement ill-gotten money is introduced to the financial system most often by breaking large amount into smaller deposits and investments.

Well look at several examples of this illegal activity and. In this example the criminal sends funds to an accountant or an attorney with instructions to hold the funds in the escrow account in order to settle a transaction. A governmental official in Brazil responsible for construction permits for real estate projects handed over his illicit corruption money in cash to his lawyer in Sao Paulo.

Each cash withdrawal will be in 100 bills and in an amount too small to trigger the reporting threshold. The six most common examples of crime associated to the placement stage in the laundering money process are. Placing large amounts of cash into a financial system commonly causes suspicion.

Review the definition of money laundering and examine the common techniques utilized by money launderers. Aborted transactions are another strategy used by the money launderer. Money Laundering Example One of the most commonly used and simpler methods of washing money is by funneling it through a restaurant or other business where there are a lot of cash transactions.

Money laundering the criminal act of disguising the source of illegally obtained money to make it usable involves three steps. After the funds are deposited the client aborts the transaction. During this stage for example the money launderers may begin by moving funds electronically from one country to another then divide them into investments placed in advanced financial options or overseas markets.

This stage entails placing laundered proceeds back into the economy to create the perception of legitimacy How Money Laundering Works. Placement layering and integration stage. Constantly moving them to elude detection.

Securities Brokers Brokers can facilitate the process of money laundering through structuring large deposits of cash in a way that disguises the original source of the funds. Blending of Funds The best place to hide cash is with a lot of other cash. This is the first step showing one example of some frequently used money laundering methods.

One common layering strategy will see a customer withdraw multiple small amounts of cash from accounts where illegal funds were deposited during placement.

Money Laundering Typology Through Business Structures Entities An Overview From Company Law Perspective Sudut Pikir

What Is Anti Money Laundering Aml Anti Money Laundering

What Are The Three Stages Of Money Laundering

Money Laundering Examples Chaussureslouboutin Soldes Fr

Stages Of Money Laundering Https Tinyurl Com Tdxavfc Socialbookmarking Seo Backlinks Onlinemarketing Influen Money Laundering Social Bookmarking Money

Cars Com Business Model Canvas Business Model Canvas Business Model Canvas Examples Online Business Models

Understanding Money Laundering European Institute Of Management And Finance

Process Of Money Laundering Placement Layering Integration

3 Money Laundering Examples That Criminals Still Use And That You Should Be Aware Of Financial Crime Academy

Advanced Audit And Assurance Aaa Understanding Money Laundering

Cv Template Business Template Academic Cv Curriculum Vitae Templates Academics Aca Curriculum Vitae Examples Curriculum Vitae Cv Template

Stages Of Money Laundering Download Scientific Diagram

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

The world of regulations can seem like a bowl of alphabet soup at times. US cash laundering regulations aren't any exception. Now we have compiled a list of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting firm centered on defending monetary services by reducing threat, fraud and losses. We have now huge bank expertise in operational and regulatory threat. We have now a strong background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many hostile penalties to the group as a result of risks it presents. It will increase the probability of major dangers and the opportunity value of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment