- Get link

- Other Apps

- Get link

- Other Apps

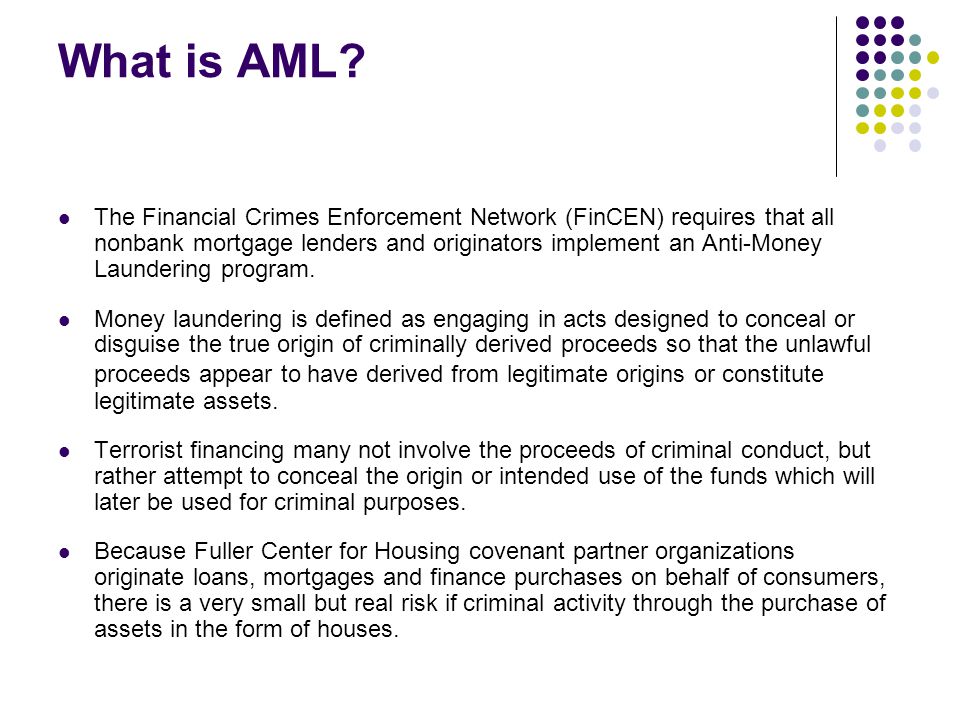

The idea of cash laundering is very important to be understood for those working within the financial sector. It's a course of by which dirty money is converted into clear cash. The sources of the cash in precise are felony and the cash is invested in a way that makes it appear like clean cash and conceal the identification of the criminal a part of the money earned.

While executing the monetary transactions and establishing relationship with the new prospects or maintaining present prospects the duty of adopting sufficient measures lie on every one who is a part of the organization. The identification of such ingredient in the beginning is straightforward to take care of as a substitute realizing and encountering such situations later on within the transaction stage. The central bank in any country gives complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such conditions.

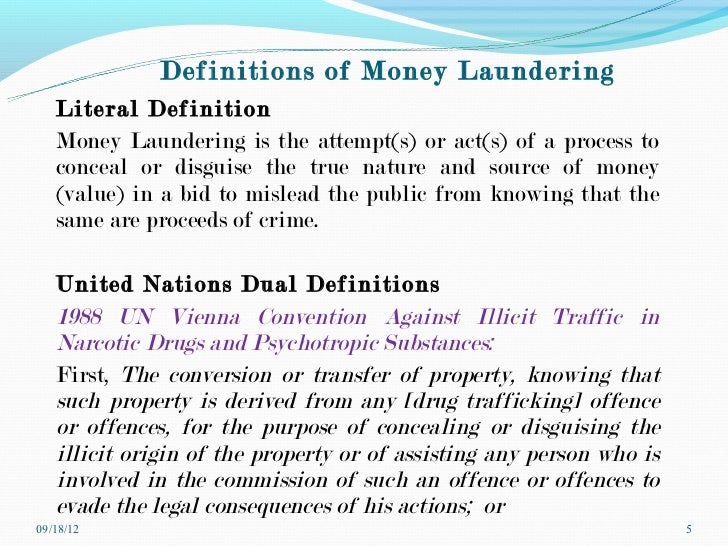

Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. The action of moving money which has been earned illegally through banks and other business to make it seem to have been earned legally.

Combating Money Laundering Terror Financing Case Of Nigeria Adv

Money laundering is the process used to disguise the source of money or assets derived from criminal activity.

Define of money laundering. Money Laundering Control Act of 1986 and any applicable money laundering-related Laws of other jurisdictions where the Company and its Subsidiaries conduct business or own assets. The scope of criminal proceeds is significant - estimated at some 590 billion to 15 trillion US. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds.

Through money laundering the criminal transforms the monetary proceeds derived from criminal activity into funds with an apparently legal source. Such proceeds then seem to have appeared from a legitimate source and thus become legal money. Money laundering is a federal crime in which large sums of dirty currency earned from illegal activity such as drug or sex crimes is cleaned and deposited into a legally sanctioned banking institutions.

The concealment or disguising of the nature of the proceeds. The acquisition possession or use of property knowing that these are derived from criminal activity. Some common methods of laundering are.

This process has devastating social consequences. Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities. What is Money Laundering.

Money laundering is the processing of these criminal proceeds to disguise their illegal origin. It is a worldwide problem with approximately 300 billion going through the. Or participating in or assisting the movement of funds to make the proceeds appear legitimate.

Means any Law governing financial recordkeeping and reporting requirements including the US. The money laundering process can be broken down into three stages. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS.

Process of Money Laundering. Money Laundering is the process of changing the colors of the money. First the illegal activity that garners the money places it in the launderers hands.

Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Money laundering is the term used to describe the act of taking illegal money from source A and making it look like it came from source B a legitimate legal source.

Money laundering refers to a financial transaction scheme that aims to conceal the identity source and destination of illicitly-obtained money. Currency and Foreign Transaction Reporting Act of 1970 the US. Its very easy to define but involves multiple techniques.

The process of taking the proceeds of criminal activity and making them appear legal. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. Money laundering involves disguising financial assets so they can be used without detection of the illegal activity that produced them.

Ad Search for results at MySearchExperts. The Placement Stage Filtering. The money laundering process is divided into 3 segments.

Definition Meaning of Money Laundering Money Laundering is the method criminals use to disguise the illegal origin and control of their wealth by passing it through a complex sequence of banking transfers or commercial transactions. Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion. Profit-motivated crimes span a variety of illegal activities from drug trafficking and smuggling to fraud extortion and corruption.

Money Laundering is an act of act of disguising the illegal source of income. Define Money Laundering Laws. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into.

Money laundering is the conversion or transfer of property. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Find info on MySearchExperts.

Authorities plan to limit cash deposits of dollars at bank counters as a measure against money laundering. This process is of critical importance as it enables the criminal.

Money Laundering Examples Chaussureslouboutin Soldes Fr

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Money Laundering Define Motive Methods Danger Magnitude Control

Money Laundering Meaning And Definition Tookitaki Tookitaki

What Is Money Laundering And How Is It Done

Cryptocurrency Money Laundering Explained Bitquery

What Is Anti Money Laundering Aml Anti Money Laundering

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

Anti Money Laundering Overview Process And History

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

How Money Laundering Works Howstuffworks

Anti Money Laundering Aml Ppt Video Online Download

The world of regulations can appear to be a bowl of alphabet soup at occasions. US money laundering laws aren't any exception. We've got compiled a listing of the top ten money laundering acronyms and their definitions. TMP Threat is consulting agency targeted on defending monetary services by reducing danger, fraud and losses. Now we have huge financial institution experience in operational and regulatory danger. We have now a robust background in program management, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many antagonistic penalties to the organization as a result of dangers it presents. It will increase the likelihood of main risks and the chance cost of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment