- Get link

- Other Apps

- Get link

- Other Apps

The concept of cash laundering is essential to be understood for these working within the monetary sector. It is a course of by which soiled money is transformed into clear money. The sources of the cash in actual are legal and the cash is invested in a method that makes it appear to be clear cash and hide the identification of the legal a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new clients or maintaining existing prospects the responsibility of adopting adequate measures lie on each one who is a part of the group. The identification of such element in the beginning is easy to cope with as a substitute realizing and encountering such conditions in a while in the transaction stage. The central bank in any nation supplies complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such conditions.

What is expected of an AML analyst. Money laundering is a type of financial crime.

Anti Money Laundering And Counter Terrorism Financing

As per United Nations money Laundering is.

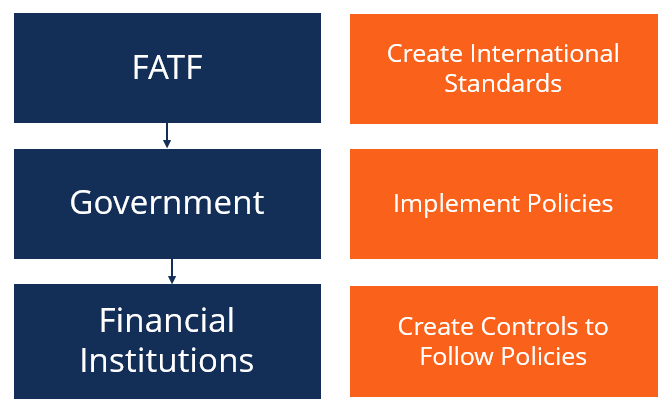

What is anti money laundering means. Initially AML laws were implemented only on financial institutions to control drug trafficking. Anti-money laundering AML refers to the fight against money launderers. It involves taking criminally obtained proceeds dirty money and disguising their origins so theyll appear to be from a legitimate source.

In most cases money launderers hide their actions through a series of steps that make it look like the money that was generated through the illegal activities was earned legitimately. Anti-money laundering refers to a set of laws regulations and procedures that come up with a view for reducing money laundering. Money-laundering is a criminal process that allows illegally-earned money to enter societys mainstream cash flow.

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. Guide to anti-money laundering checks Businesses in the affected sectors have to constantly adapt to a plethora of laws directives and regulations. It prevents criminals from recovering illegal gains of their crimes as well as using the money for future criminal activity.

Anti-money laundering regulations are the rules for businesses institutions and even countries to eliminate money laundering and terrorist financing activities. Money laundering is something that damages the economy on a global level but this doesnt stop individuals from getting involved with the money-making schemes themselves resulting in a problem that isnt going away anytime soon. AML laws require that financial instutions report any financial crime they detect to relevant regulators.

What is Anti-Money Laundering AML. Though anti-money-laundering AML law covers a limited range of transactions and criminal behaviors their implications are far-reaching. Anti-money laundering refers to the laws regulations and procedures designed to prevent money laundering.

Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Given that regulations to uphold anti-money laundering AML are attached to financial products and services around the world the international community is clearly in agreement about the threat that money laundering poses to the global economy.

AML is an abbreviation for anti-money laundering. Anti-money laundering refers to all policies and regulations that are in place to prevent the abuse of legitimate financial systems to hide or disguise the proceeds of crime. The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money.

What It Is Why It Matters. Anti-money laundering AML refers to a set of procedures laws or regulations designed to curb the practice of generating income through illegal means. Anti-money laundering AML refers to the activities financial institutions perform to achieve.

Money laundering is when criminals integrate their illegally-obtained cash into the financial system so it looks like it was earned legitimately. Money laundering means the ways in which change dirty money and other assets into clean money or assets that have no obvious links to their criminal origin.

Arab Republic Of Egypt Detailed Assessment Report On Anti Money Laundering And Combatting The Financing Of Terrorism

Live Training Session For Cami In 2021 Live Training Money Laundering Session

Anti Money Laundering Overview Process And History

Anti Money Laundering Overview Process And History

What Is Anti Money Laundering Aml Anti Money Laundering

What Is Anti Money Laundering Aml Money Laundering Financial Literacy Money

Anti Money Laundering In Indonesia What You Need To Know

A Guide To Anti Money Laundering Aml Compliance Veriff

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering Overview Process And History

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Anti Money Laundering Fuzzy Logix

The world of laws can appear to be a bowl of alphabet soup at instances. US cash laundering rules are no exception. We have now compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on protecting monetary services by decreasing risk, fraud and losses. We have now huge bank expertise in operational and regulatory threat. We've got a powerful background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many hostile penalties to the organization as a result of risks it presents. It will increase the likelihood of major dangers and the chance value of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment